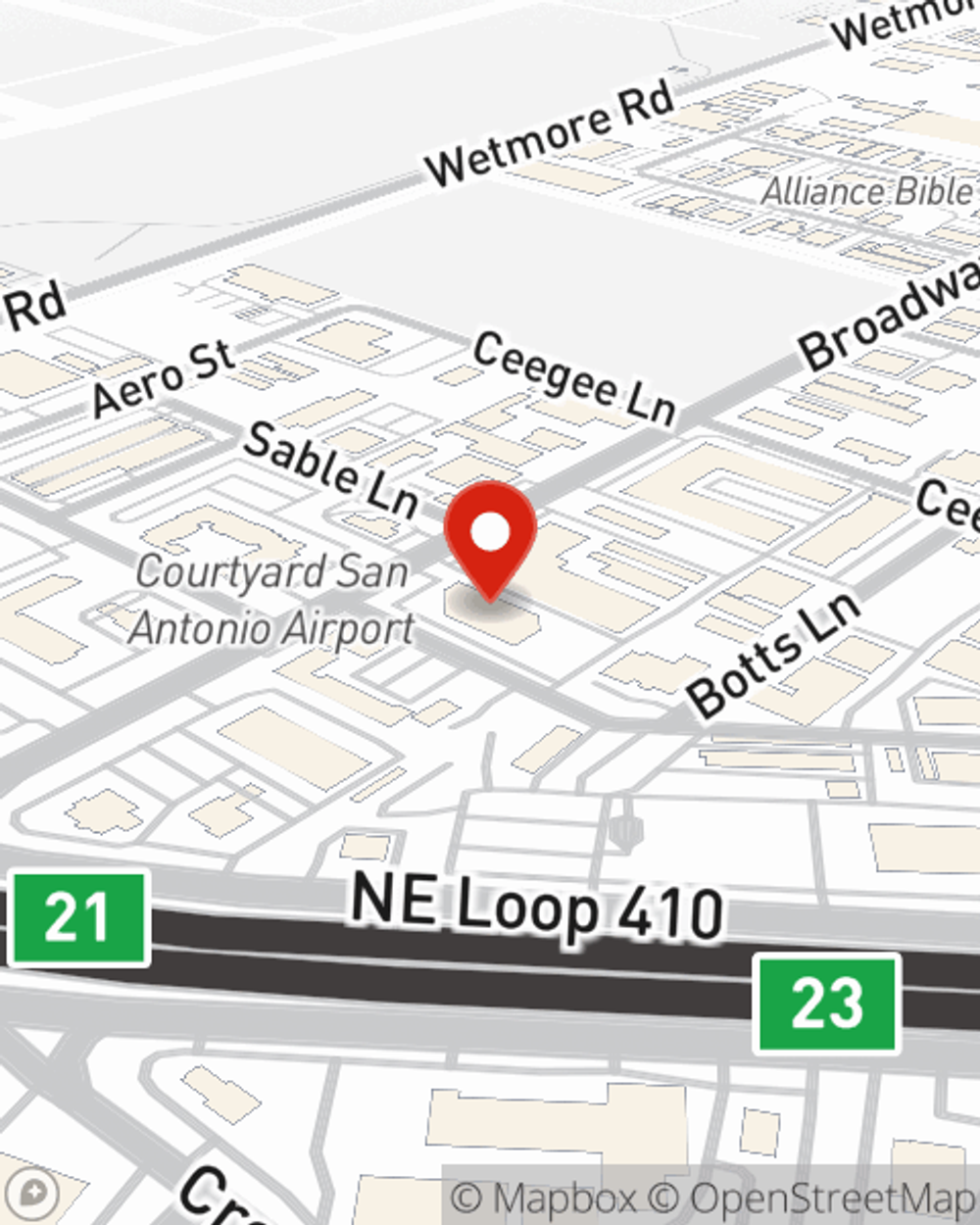

Life Insurance in and around San Antonio

Coverage for your loved ones' sake

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Boerne

- Kendall county

- Guadalupe county

- Bexar County

- Atascosa County

- Bandera County

- Hays County

It's Time To Think Life Insurance

It can be a big deal to provide for your loved ones, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that those closest to you can maintain a current standard of living and/or pay off debts as they grieve your loss.

Coverage for your loved ones' sake

Life won't wait. Neither should you.

Why San Antonio Chooses State Farm

Fortunately, State Farm offers several policy choices that can be adjusted to match the needs of your family members and their unique situation. Agent Cassie Thompson has the personal attention and service you're looking for to help you settle upon a policy which can help your loved ones in the wake of loss.

Simply talk to State Farm agent Cassie Thompson's office today to experience how a company that processes nearly forty thousand claims each day can help cover your loved ones.

Have More Questions About Life Insurance?

Call Cassie at (210) 822-2220 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Cassie Thompson

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.